Fleet insurance is essential to cover your organisation and drivers against a variety of events, including collisions with other vehicles and theft.

Fleet insurance is essential for organisations that operate one or more vehicles. It can cover a variety of vehicle types and provides protection tailored to your specific needs. Read startrescue.co.uk’s beginner’s guide to understanding fleet insurance.

Fleet Insurance Covers The Vehicle, Not The Driver

The first thing to know about fleet insurance is that coverage is for the vehicle in question, and is not based on who is driving the vehicle. This way, different drivers can use a given vehicle without any worries over insurance coverage.

Specific Vehicle Type, or Mixed Vehicle Insurance?

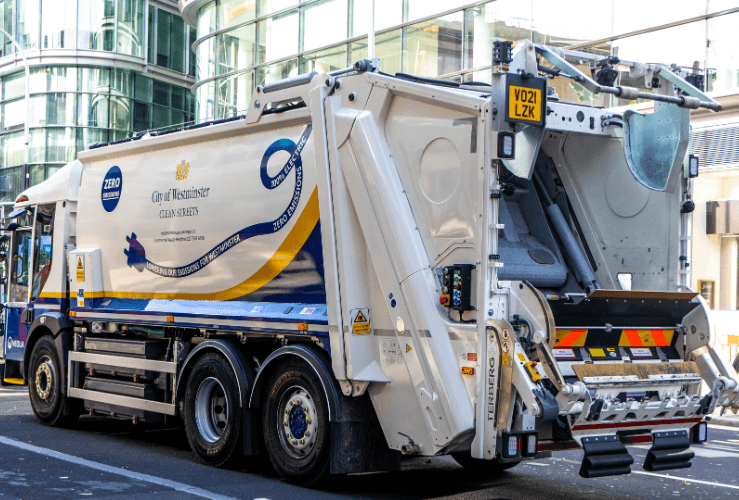

Fleet insurance is available for a variety of vehicle types. Some policies may cover specific vehicles, such as articulated lorries, while others may offer coverage for a combination of vehicle types (Mixed Vehicle). Commonly-insured vehicles include:

- Articulated Lorries (including trailer cover if required)

- Rigid Lorries

- Tippers

- Tankers

- Flatbed Trucks (including crane cover if required)

- Bulk Carriers

- Concrete Mixers

- Dustcarts

- Skip Lorries

- Refrigerated Lorries

- Livestock Lorries

- Trucks over 7.5 tonnes

- Vans

Credit: Martin Lee - stock.adobe.com

What to Look for in a Good Fleet Insurance Policy

Here are some features/benefits you might need in your fleet insurance policy:

- A flexible policy that covers different vehicle types

- Low policy excesses

- 24-hour helpline

- The option to spread the cost

- Like-for-like vehicle replacement while yours is off the road after a "non-fault" accident

- Wide range of vehicle weights covered (e.g., 7.5 - 150 tonnes)

- Discounted cover for each additional vehicle added to the policy

The Two Main Types of Fleet Insurance

There are two main types of fleet insurance, Carriage of Own Goods, and Haulage:

Carriage of Own Goods Insurance

This insurance type covers you for the carriage of your own business items. This would apply, for example, to a scaffolder, landscape gardener, or ground worker. Specific options may be available to cover businesses such as these.

Haulage Insurance (Carriage of Goods For Hire and Reward)

In contrast to Carriage of Own Goods Insurance, Haulage Insurance covers you to carry the goods of other organisations.

What Levels of Cover Are Available?

Just as with private motor insurance, there are three levels of cover for fleets:

- Comprehensive - this covers both parties after an accident, where the policyholder is at fault.

- Third Party Fire and Theft - this covers the policyholder against vehicle fire and theft (including vandalism) and third party damage when they are not at fault.

- Third Party Only - this covers third parties against damage when they are not at fault.

How Much Will the Excess Payment Be?

The excess is the amount you pay towards any insurance claim. The excess payment will vary depending on your specific insurance policy, but many policies stipulate a £500 excess.

What Is 'Any Driver' Cover?

'Any Driver' insurance covers drivers of any age. This may be a wise option if you have a high turnover of drivers or a large roster of drivers. However, the 'Any Driver' coverage will be more expensive than a policy designed for drivers over certain ages - for example, 23 or 25.

If you know your drivers will all be 25 or over, then avoiding 'Any Driver' coverage could save you money on your premium.

With 'Any Driver' policies, you may be asked for information on the claims and conviction histories of all drivers.

Are No Claims Bonuses Available with Fleet Insurance?

Yes, No Claims Bonuses are offered with fleet insurance policies. They work in a similar way to private motor insurance policies. However, some providers may have limits on how high No Claims Bonuses can go - usually between 40% and 60%.

Some providers offer introductory No Claims Discounts for experienced lorry drivers.

What If You Need to Travel to Mainland Europe?

If your policy covers fleet operations in the UK but you need to travel to mainland Europe, it should be possible to obtain a Green Card extension. For more regular trips to the continent, the insurer should be able to issue an Annual Green Card.

What Kind of Organisation Can Take Out Fleet Insurance?

Fleet insurance is available for a range of different types of customer, including:

- Proprietors

- Partnerships

- Limited companies

- Charities

Do I Need an Operator's Licence?

If your organisation operates vehicles over 3.5 tonnes, you will need an Operator's Licence. However, there are some exceptions; learn about these on gov.uk: Operator's Licence.

It takes around three months to obtain an Operator's Licence. An insurer may be able to offer limited cover in the interim period.

Getting a Good Deal on Fleet Insurance

As with insurance for private vehicles, it's important to shop around for a deal that offers good coverage for an affordable premium. The very cheapest cover may not always be sufficient for your company's needs (see below).

Money Back Guarantees

Some brokers and providers offer money back guarantees or price matching if you find a lower-cost premium with the same coverage within a certain period - for example, 48 hours.

Cooling Off Period

Just as with private insurance policies, with commercial fleet insurance, you have a minimum 14-day "cooling off" period, during which you can cancel your policy for any reason with no financial penalty. Some policies may have a longer 30-day cooling off period.

However, if you decide to cancel the policy after this period, you may be charged a fee or a percentage of the sum paid. It's important to be aware of such fees before you take out a policy.

Does Cheaper Mean Better?

It's important to take out sufficient coverage for your fleet. This means opting for the cheapest policy may be a false economy - in the same way that buying the lowest priced motor or travel insurance can be.

In particular, you need to ensure you are financially protected against expensive costs such as vehicle write-offs or injuries to staff or third parties. You need to ask: Will my company be able to continue functioning based on the policy payouts, if the worst happens?

What Else Might I Need, Aside from Fleet Insurance?

Other important services and cover you may need include:

- Breakdown cover: This will help you get back up and running as quickly as possible if one of your vehicles suffers a breakdown.

- Goods in Transit Insurance: This covers loss, theft, or damage of goods being transported by your company. UK and/or EU cover is available.

- Legal Protection Cover: In the event of a non-fault claim, this can help you recover uninsured losses including policy excesses, loss of earnings, and claims for any injuries sustained. This is usually an inexpensive add-on.

- Public Liability Insurance: This protects you if you are deemed legally responsible for injuries to other people or damage to third parties.

- Employer's Liability Insurance: This is mandatory in the UK. It means you are covered for any claims related to injuries sustained by staff. The minimum legal coverage is £5 million, but most policies offer £10 million of coverage.