Car tax, road tax, vehicle excise duty (VED) - this tax goes by many names.

Some form of road tax has been around in Britain since 1888, and specifically for motor cars since 1920.

The money raised from VED goes towards the upkeep of the national road network.

If you fail to pay road tax for your vehicle and get caught driving without tax in place, you risk being fined up to £1,000, or five times the amount of tax chargeable, whichever is greater.

Does every vehicle need to have road tax?

Driving without tax is not allowed. No matter who you are or what you drive, you will need to apply for vehicle tax - although you may not need to pay for it.

If you own a vehicle that you do not currently drive and is not kept on public roads, it is possible to declare the vehicle as SORN. If a vehicle is SORN, you will not be required to pay road tax, until the vehicle is taken off of SORN.

We’ll cover how to SORN a vehicle in more detail later on in this article.

Can I drive a car without tax?

Most vehicle owners will need to pay some form of vehicle tax, but some won’t.

Road tax exemptions apply to some disabled drivers, as well as to electric vehicles and some historic or classic cars. However, exempt drivers are still required to apply for road tax.

The only time driving without car tax is allowed is driving to a Mot centre for a pre-booked MOT.

On the way to the MOT centre

If you are driving to a pre-booked MOT test, you can drive without car tax. However, the purpose of the journey must be solely for the MOT - stop-offs at the supermarket or to visit relatives would be pushing it!

MOT road tax checks can and do happen.

Learn more at gov.uk's vehicle exemption page.

Can you tax a car without an MOT?

No, you need a valid MOT before you can tax a vehicle. However, you can drive to the MOT centre without road tax, as mentioned above.

Can I drive home from MOT centre without road tax?

You can only drive a vehicle with a SORN on a public road to go to or from a pre-booked MOT or other testing appointment, and the car must be insured

Some insurance companies will declare your insurance void without an MOT or road tax. It’s vital that you check your insurance policy wording, else you will effectively be driving without any insurance if you drive your vehicle without appropriate road tax in place.

It’s also worth noting that if your vehicle has failed its MOT, you can only take your vehicle away if your current MOT certificate is still valid and no ‘dangerous’ problems were listed in the MOT. Otherwise, you’ll need to get it repaired before you can drive.

Find out more details about MOTs in our MOT guide: Common questions answered

What if I park my car on a public road but never use it?

If you keep your car on a public road you must pay vehicle excise duty - even if you never drive it.

What if I park my car on private land and never use public roads?

If you store your vehicle on private land (including a private garage) and never use - nor plan to use - public roads, then you do not have to pay vehicle excise duty.

However, you must register your untaxed vehicle as ‘SORN’ - which stands for Statutory Off Road Notice.

This might be an option if you're planning a long trip overseas; restoring a vehicle; or otherwise not intending to use a vehicle for a prolonged period.

How long does a SORN last?

SORNs once lasted for 12 months and then expired. However, SORNs now are in effect until cancelled.

How much does it cost to declare my car SORN?

It is free to declare your vehicle SORN.

To declare your vehicle SORN, simply visit gov.uk or complete form V890.

You will need to check the address in your VC5 logbook is up to date, since this is where any VED refunds will be sent.

What are the penalties for driving a SORN-registered car?

The authorities take a dim view of anyone who drives their SORN-registered car on public roads.

It is an offence to drive a SORN-registered vehicle on public roads - and one considered more serious than simply not paying your road tax - because there is an element of fraud.

Offenders could face a fine of up to £2,500, or five times the amount of tax chargeable, whichever is greater.

When must you tax a new car?

Any newly-purchased car must be taxed at the point of sale. This rule applies to brand new vehicles as well as the purchase of used vehicles.

Back in the days of the old paper disc, there was a five-day grace period to allow for the new disc to arrive by post. With the digital system, this leeway is no longer necessary.

Car tax when buying a used car

Since 2014, car tax has no longer been transferred to the new owners of a used car. This means if you buy a second hand vehicle it will always be untaxed and, as mentioned above, you must tax it at the point of sale.

You risk being fined if you drive off without appropriate road tax in place

Conversely, if you are selling a used car, you can have any remaining car tax refunded.

What documentation do I need to tax a newly purchased second hand car?

Whenever you purchase a second hand vehicle, the seller should give you the green section of the car's log book (new keeper supplement) or V5C/2.

The V5C/2 will detail a 12-digit reference number which can be used to tax the car either online, or at the Post Office.

Dealers will normally do this for you before you drive the vehicle away.

Don’t forget, if the car is over three years old, it will need an MOT.

Tax vehicle without V5/V5C: How to tax a car without V5/V5C

If you do not have a V5 logbook, you'll need another identifying piece of information to tax your vehicle.

You need the V5, V5C or equivalent paperwork to prove you are the owner and apply for car tax.

To get VED on your vehicle, you'll need one of the following:

- V11 reminder letter

- V5C logbook registration certificate registered in your name

- V62 logbook application form (when the vehicle is registered in your name)

- V5C/2 Green slip, new keepers supplement (you get this having just bought the vehicle not registered in your name)

Find out more about how to pay road tax

How do I tax a new vehicle?

This should be arranged by your dealer. But don't forget you'll also need valid motor insurance before you can drive off the forecourt.

If you imported or built the car, then registering and taxing the vehicle is down to you. You'll need form V55/4.

If you're selling your old car, you'll need to send the applicable parts of the V5C to the DVLA.

You could face a fine of up to £1,000 if you do not tell the DVLA about the change of ownership. And remember, you'll also get a refund for any unspent road tax.

Can you tax a car without insurance?

No, you need to have car insurance in place before you can apply for road tax.

Is car insurance valid without car tax?

Generally, your car insurance is still valid even if your car tax runs out. But different insurance companies have their own rules.

Some insurance companies may stipulate having valid car tax in place as a condition of insurance, so it’s important to check your policy.

As car tax is a legal requirement, you should not be driving your car without tax.

Should I have insurance for a SORN vehicle?

If you declare your car as SORN, your car may still be stolen or damaged while declared off-the-road, so you may wish to continue insuring it.

You can get laid up car insurance – also called SORN insurance – for your car while it has a SORN.

Recently passed your test?

If you've recently passed your practical driving test, you won't need to worry about vehicle excise duty until you get your first car.

How much you pay for road tax will depend on fuel type, CO2 emissions, engine size and when the car was registered.

Needless to say, those on a budget will look for vehicles in a lower tax bracket.

How do police catch drivers without VED?

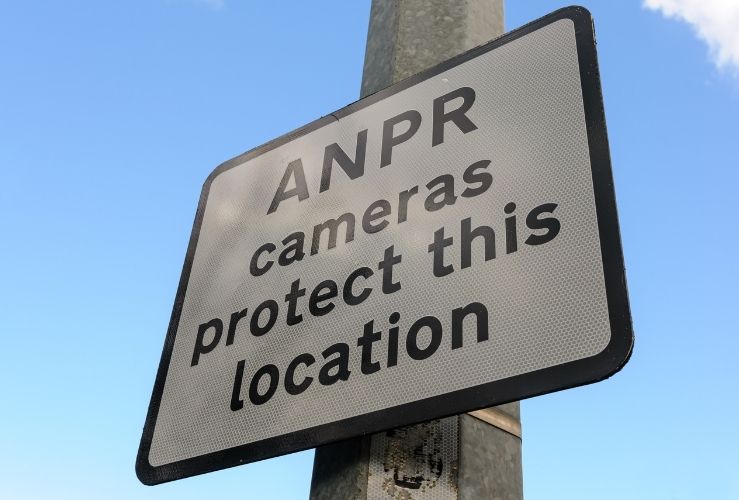

In years gone by, police would manually check the paper tax disc displayed on a car's windscreen. Today, however, the police use Automatic Number Plate Recognition - ANPR - to compare number plates with the DVLA's VED database.

If you’re found to have an untaxed car, the police may issue you with a fine.

Does temporary car tax exist?

There is no such thing as a temporary car tax in the UK. As driving without tax is not legal, if you drive on a public road you must have road tax.

However, if you only need to use the roads for a single short journey, you can pay the minimum of six month’s road tax, then, after your trip, you can request a refund on the remaining VED.

What are the penalties for not taxing your vehicle?

It's near impossible to avoid paying road tax these days - since the DVLA runs monthly checks of all registered vehicles nationwide.

Should the DVLA system identify an untaxed car or non-SORN-declared vehicle, a letter and an £80 untaxed vehicle fine will be sent out to the owner's address. But you won't get any points on your licence, and the fine is halved if you pay within 33 days.

The DVLA can also clamp your vehicle until the appropriate road tax is paid.

What are the penalties for driving without tax?

If you are caught driving without tax on a public road, an out of court settlement (OCS) letter will be issued.

An OCS is set at £30 plus one and a half times the outstanding vehicle tax

Failure to pay this penalty for driving without tax could result in a penalty of either £1,000 or five times the amount of tax chargeable, whichever is greater.

Suspicious DVLA-scam emails

In recent years there has been a rise in spam emails purporting to be from the DVLA and offering refunds on road tax payments.

The scam email then presents a link to click on which encourages the user to enter their personal details, which might then be used for identity fraud or other crimes.

In response to these scam emails, the DVLA said, “We don’t send emails or text messages that ask you to confirm your personal details or payment information, such as for a vehicle tax refund.

“If you get anything like this, don’t open any links and delete the email or text immediately.”

Has my car got tax?

You can check if your car has car tax by visiting gov.uk.

Frequently Asked Questions on Driving Without Road Tax

Will I receive a penalty for no MOT or road tax?

If you are caught driving without tax or an MOT you could face a penalty fine.

The only time you can drive an untaxed car is when driving to a pre-booked MOT.

What is the penalty for not paying road tax?

If you don't pay road tax on time, you'll be sent a late licensing penalty (LLP) of £80.

This is reduced by 50% if paid within 33 days.

What happens if I get caught driving without car tax?

If an ANPR identifies you as driving without car tax, an automated letter and an £80 untaxed vehicle fine will be sent out to the owner's address. If you pay within 33 days, the fine is halved.

If you don't pay, the fine could rise as high as £1,000 should the case go to court. The DVLA can also clamp your vehicle until the appropriate road tax is paid.

You won’t receive any points on your driving licence if you are found driving without car tax.

If the police catch you driving without car tax, they may issue you with a fine and could potentially impound you car

How much does it cost to get a car back after it has been impounded for having no tax?

Having your vehicle impounded for no road tax can be expensive.

The following fees apply:

- £200 impound release fee

- £21 per day storage fee (beginning once the vehicle has been removed to the vehicle pound)

A surety fee of £160 is payable if you have not taxed your car by the time the vehicle is released. This can be refunded if proof of vehicle tax is produced within 14 days of the payment being made.

I forgot to tax my car, will I get fined?

If you don’t tax your car or tell the DVLA it’s off the road, you could face an £80 untaxed vehicle fine.

Is there a grace period for road tax?

No, you need road tax the moment your vehicle is on a public road.

There used to be a grace period of five days - but that was when the paper tax disc was issued and needed time to arrive by post.

Can you get points on your licence for not having road tax?

No, you will not get points on your licence for not having road tax.

Does not having VED invalidate insurance?

Although you are not legally allowed to drive on public roads without VED, your car insurance may still be valid even if your car tax runs out. Check your policy wording for details.

Can I claim road tax back?

Yes, if you buy 6 or 12 months of road tax but do not plan to use it for the entire period, you can receive a refund from the DVLA.

If you cancel your vehicle tax by telling DVLA you no longer have the vehicle or it’s off the road, you will automatically get a refund cheque for any full months left on your vehicle tax.

The refund is calculated from the date DVLA gets your information.

Can I tax my car while awaiting my logbook?

Yes, you can apply for car tax at the Post Office while awaiting your V5C logbook.

You can also request a new V5C at the Post Office.

Can speed cameras detect absence of VED?

No, generally speaking speed cameras only gauge speed. However Automatic Number plate Recognition (ANPR) cameras CAN read your number plate and therefore detect if your VED has lapsed.

What happens to road tax when a car is sold?

The seller of a vehicle will get a refund of any remaining VED. The new owner must take out their own VED on the vehicle.

It was once possible to transfer VED across to the new owner, but this is no longer the case.